One illustration of the SEC Revolving Door

Scott W. Bauguess, 11-year employee of the SEC Division of Economic and Risk Analysis (DERA), and John M. Griffin (President of Integra FEC) were in the finance program at Arizona State University from 1999-2003. See Bauguess CV and Griffin CV.

In 2016, Mr. Bauguess was the Deputy Director of DERA and Deputy SEC Chief Economist. Mr. Griffin was the Centennial Chair in Finance at the McCombs School of Business, University of Texas, Austin, as well as President of Integra FEC. Mr. Griffin was invited to the SEC in May 2016 as one of just five Distinguished Visiting Scholars, including a presentation of his paper “Do Personal Ethics Influence Corporate Ethics?“, examining white-collar SEC defendants and infidelity.

By late 2016, Mr. Griffin had skills the SEC was willing to pay for. Mr. Bauguess, now Acting Division Director and Acting SEC Chief Economist, had authority over DERA’s budgets and contracts. He appointed Robert Michael Willis to DERA’s contract Advisory Committee, together with Kimberly D. Coronel and her Office of the Managing Executive (ME), to control DERA’s contracting mechanisms.

Coronel’s underling, Robert S. Gunning, submitted weekly status reports on budget, acquisition, and staffing. His reports between November 30, 2016 and May 24, 2017 document discussions between ‘DERA Management’, ‘Enforcement’ and the SEC Office of Acquisitions (OA) concerning a contract with Integra FEC. Several reports document that OA strongly suggested using existing contracts, stating it was “continuing to look at ways to use the [existing] DAS contract”.

Nevertheless, both ‘DERA Management’ and ‘Enforcement’ insisted on sole-source contracting, with newly-preferred contractor Integra FEC. OA eventually gave in, both on onboarding Integra and the method of contract solicitation. Gunning’s March 8, 2017 status report documented: “OA looking at use of Expert Witness determination to process sole-source action”.

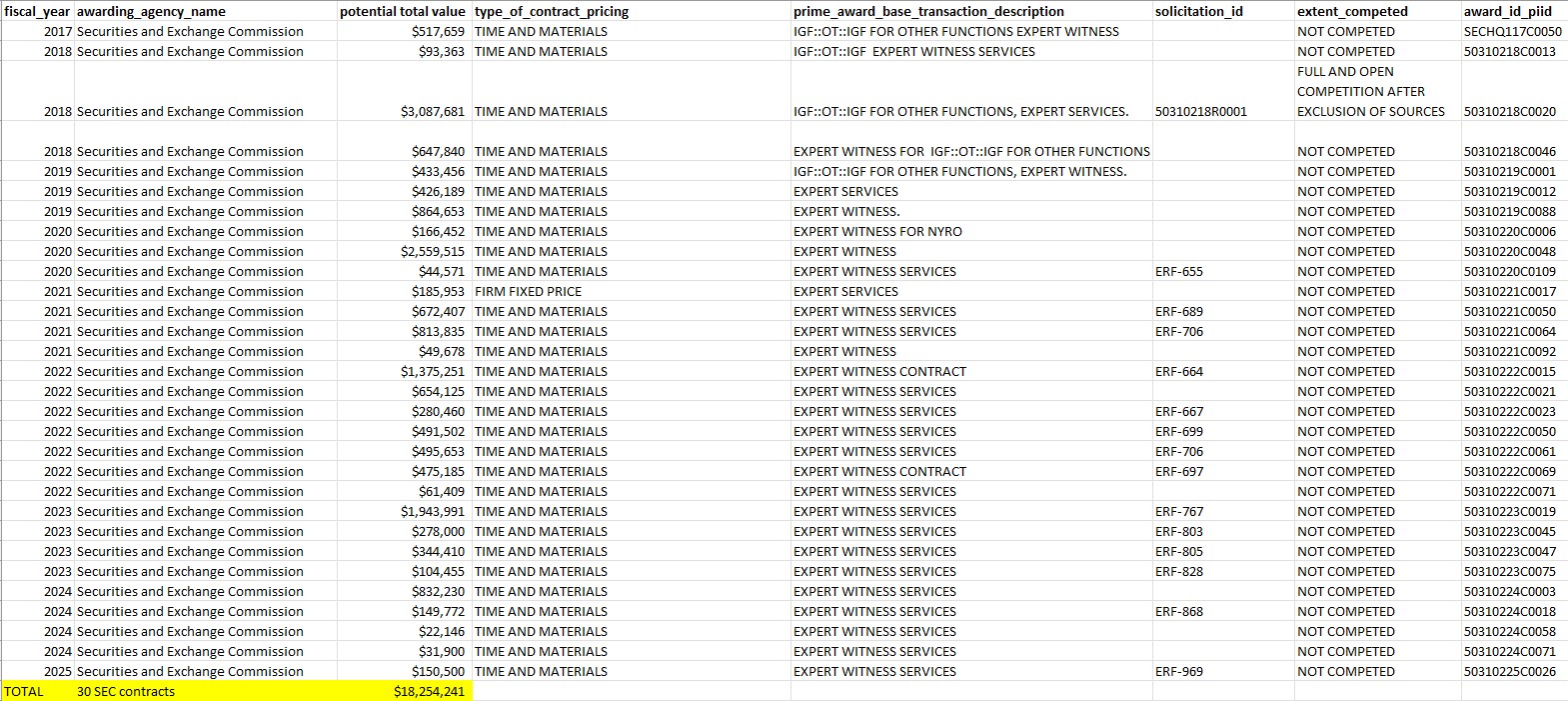

On May 30, 2017, SEC DERA awarded a $517,659 ‘expert witness’ sole-source (non-competitive) time-and-materials contract to Integra FEC for “Credit Ratings Expert and Advisory Support Services” – Integra FEC’s first federal contract. Enforcement contracts soon followed, the first a $3.1 million ‘expert services’ ‘negotiated proposal’ time-and-materials contract on March 26, 2018. Integra was fully initiated into the DERA and Enforcement ‘friends w/federal benefits’ clubs.

On August 31, 2017, the SEC named Jeffrey H. Harris Director of the Division of Economic and Risk Analysis and Chief Economist. Mr. Harris authored three economic papers with John M. Griffin (2011, 2007, 2003). From 2018-21, the DERA credit ratings contract work was subcontracted by Integra – to a husband and wife team of ‘Contract Economists’ employed at Harris’ American University Kogod School of Business and at Harris wife’s Georgetown University McDonough School of Business.

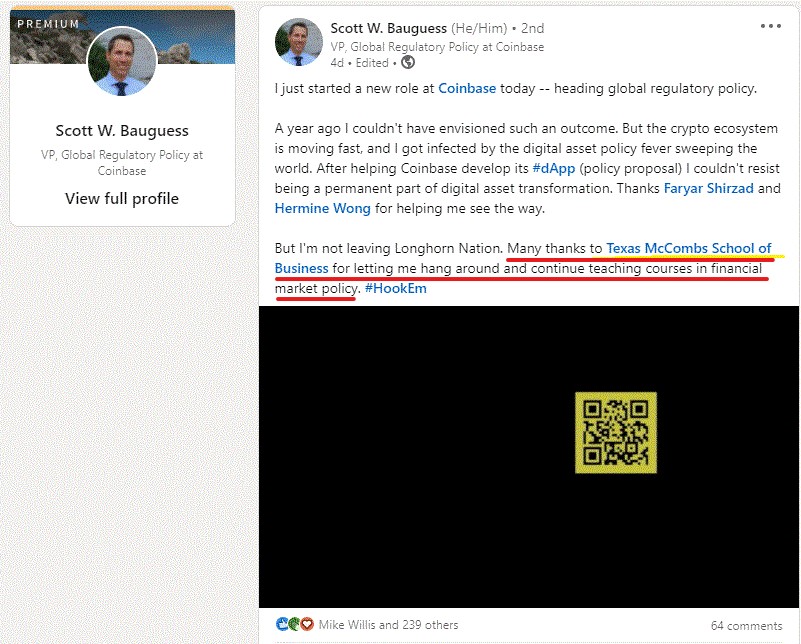

On December 19, 2018, Integra’s DERA contract work product, the SEC’s credit rating analysis program, was publicly questioned by Reuters. Two days earlier, an SEC Press Release announced Mr. Bauguess’s departure from the SEC. His landing spot: Mr. Griffin’s McCombs School of Business, as Director of its Salem Center for Policy, and Clinical Associate Professor. #HookEm.

Forward to February 2022: in another round through the Revolving Door: Mr. Bauguess reunited and was congratulated by his SEC friends for his new job as V.P. of Global Regulatory Policy at Coinbase (never hurts to keep your ‘friends w/federal benefits’ [formerly] close). Attorney Hermine Y. Wong exited the SEC Revolving Door for Coinbase in late 2018, shortly after she was featured in my Whistleblower statement. Meanwhile, Robert Michael Willis had achieved his promotion described in my Whistleblower statement and congratulated the team. Mr. Griffin kept his friend Dr. Bauguess close, retaining him on the U. Texas payroll as a Visiting Senior Scholar and Clinical Associate Professor at the McCombs Salem Center for Policy (see LinkedIn posts below).

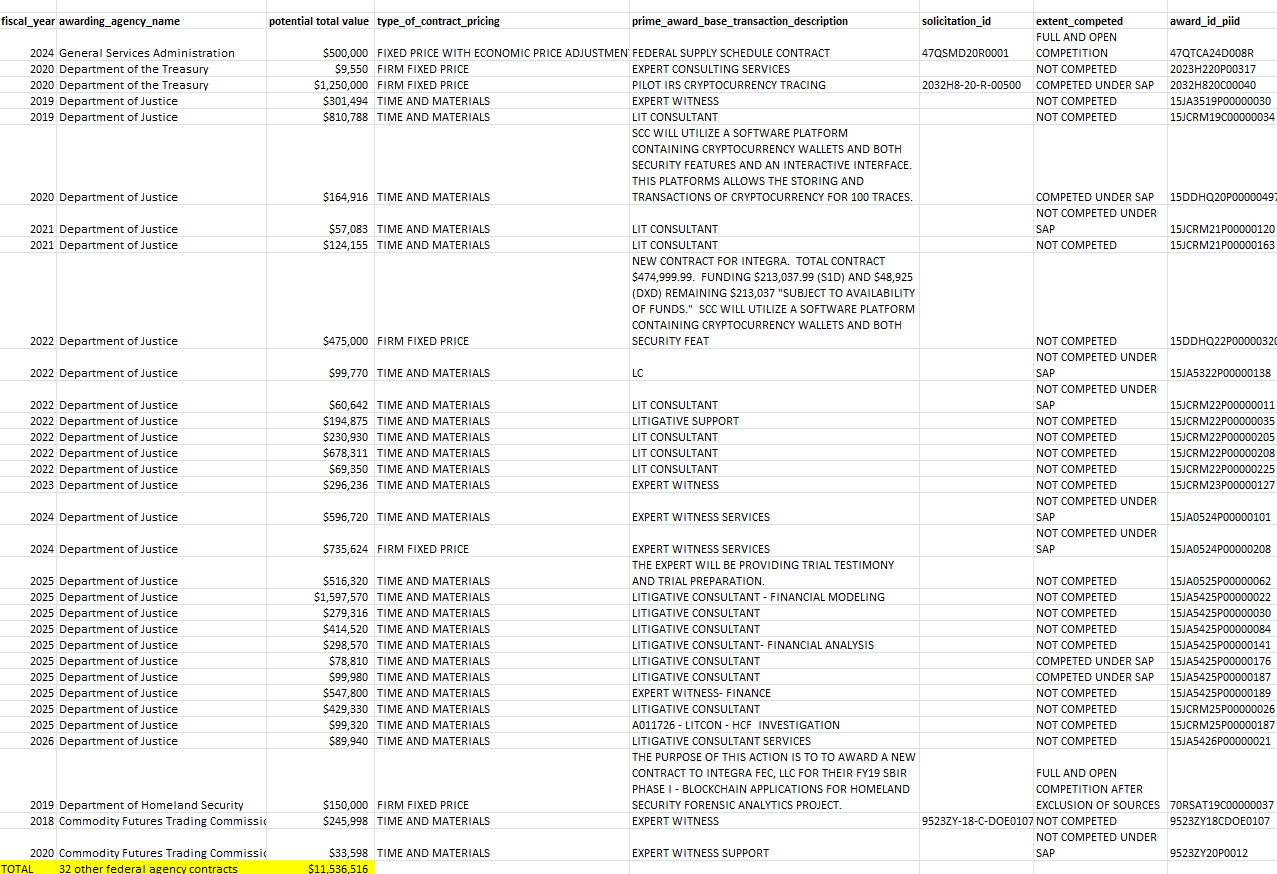

Integra FEC has gone on to receive a total of 30 SEC contracts worth $18.3 million, plus $11.5 million from 32 contracts at other federal agencies (as of January 2026). Integra FEC continues to provide ‘sole-source’ ‘expert’ services at ‘time-and-materials’ contract pricing. The SEC’s required justification for sole-sourcing contracts with Integra FEC: “Only one responsible source and no other supplies or services will satisfy agency requirements.”

Integra FEC’s slate of contracts with the SEC (USASpending.gov, January 2026):

Integra FEC’s contracts with other federal government agencies (USASpending.gov, January 2026):

Here is the full spreadsheet for these charts, with permalinks to the contracts, summarized from USASpending search results for ‘Recipient’ Integra FEC using its Unique Entity ID (UEI): MHSDCKN6YDJ4.

In February 2022, Scott Bauguess congratulated himself on LinkedIn for his two trips through the Revolving Door (U. Texas McCombs and then Coinbase). Former co-workers featured in my Whistleblower report (Hermine Y. Wong and Mike Willis) were thrilled to reunite on the other side of the Door, and congratulated Mr. Bauguess’ new ‘opportunity’. Mr. Bauguess didn’t forget to thank U. Texas McCombs for nevertheless continuing him on the payroll!

The Games That SEC Economists Play

I’ll never understand the SEC “Economist Survivor” game. It’s unfair. Seems economists are dying to get into the SEC, battle each other for jobs and survival, take punishments gracefully, and kill others’ careers for rewards.

Exhibit 1: an example. Two DERA economists broke government rules when interviewing a spouse for an SEC position. They were investigated by the SEC Inspector General. Why were there unequal punishments, but in the end they all fell down, except Scott Bauguess?

The male economist limped back into the DERA game as the female economist was demoted (see email below). Sad for her (at least until she got a soft landing with other female SEC alumni sacrificed for Bauguess’ 2016 promotion from sharing a co-Deputy position to becoming the Acting Division Director and Chief Economist, & even more SEC alumni on the other side of the Revolving Door).

The male economist was not safe for long however. In 2018 he lost SEC employment when Scott Bauguess removed him using the performance management system to make way for friend promotions [discussion and email snip on the Sunlight Disinfects home page].

But still, in 2016, Scott W. Bauguess was happy because he could create a new SEC Senior Officer/Associate Director position for his ‘friend w/federal benefits’ Hari Phatak, who soon after was officially promoted by SEC Press Release. It was at least the second of Mr. Bauguess’s promotions of friends, in addition to his own 2016 promotion to Acting Division Director (above), that required his female co-Deputy Director to sacrifice her SEC career.

The SEC Revolving Door only opens OUT, if you’re a Financial Economist suggesting how to make EDGAR data more accessible to the public and save taxpayer funds on DERA’s contract spending

In 2012, Maris Jensen was a Financial Economist employed in DERA’s Office of Corporate Finance. She was terminated by her boss, then Assistant Director Scott Bauguess, for “lack of respect for senior management”.

Her offense: “I told my boss” that [the SEC] is “literally paying others millions and millions to write [EDGAR data extraction] programs I offered to them for free.” Noting that DERA uses “EDGAR data they repurchase in usable form for millions each year, but do nothing to fix it. Companies are chastised for insufficient and inefficient disclosure, while the SEC fails to help retail investors navigate corporate disclosures at all.”

As Ms. Jensen explained in a 2014 article on Institutional Investor:

Jensen went to on to create a website* to gather EDGAR data, index it, and return it in investor-friendly formats. Her website bemoaned, “Why did I have to build this?”

* rankandfiled.com “SEC Filings for Humans“; screengrab; website currently inactive

The SEC Revolving Door for Friends and Family

a.k.a. The story of the SEC Financial Economist who collected two years of pay after departing the SEC:

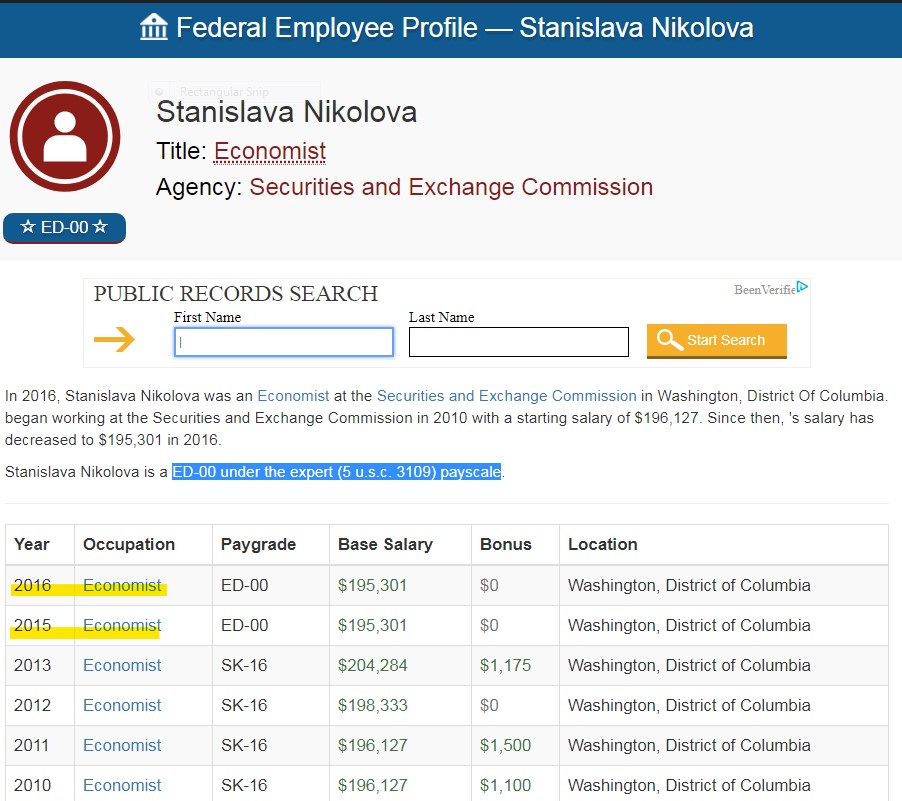

Scott Bauguess was sorry to see Stanislava Nikolova, his ‘female friend w/federal benefits’ and academic Senior Financial Economist teammate, depart from SEC DERA in late 2013. But in 2015-16 Bauguess was Deputy Director and Deputy Chief Economist and kept “Stas” close by re-employing her full-time for two years titled as an “Economist”/ED-00 Consultant, paying her former salary of nearly $200,000.

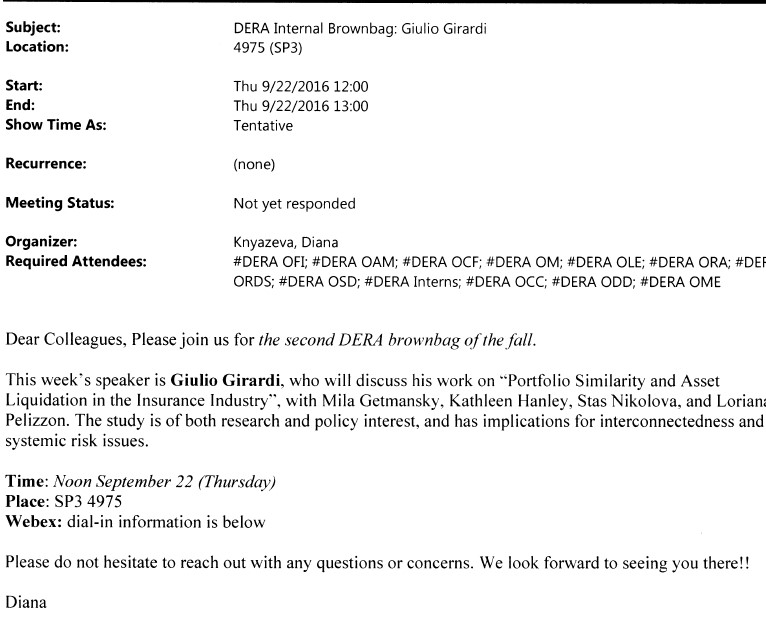

Could Stanislava Nikolova work full-time for the SEC in Washington, DC while also a professor at the University of Nebraska? Why was she paid for two years at her former SEC salary? Federal law specifies that a consultant may not receive greater than GS15, step 10 pay: $132,122.00 in 2015. Ms. Nikolova was paid +$60,000 more for two years. What was the consultant work product? While being paid by the SEC in September 2016, Ms. Nikolova did not attend a DERA ‘brownbag’ lunch where a paper she co-authored on the insurance industry was presented. More questions than answers, and more taxpayers dollars spent: for what?

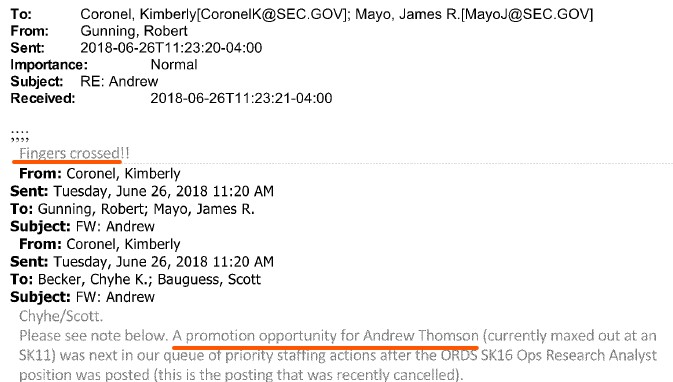

DERA ‘friends w/federal benefits’ are eligible for annual promotions after grooming for “our list to get a promo”

In fact, promotions opportunities may happen the month following, while DERA Senior Officers and decision makers for the promotion wink and cross fingers in emails:

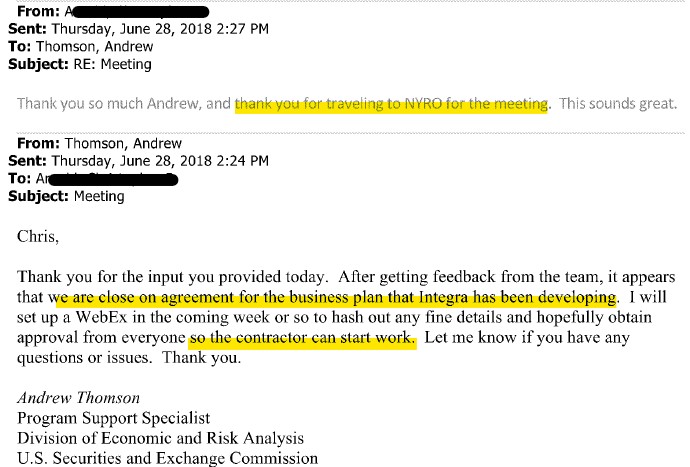

Andrew Thomson was even trusted with DERA’s business plan for Integra FEC:

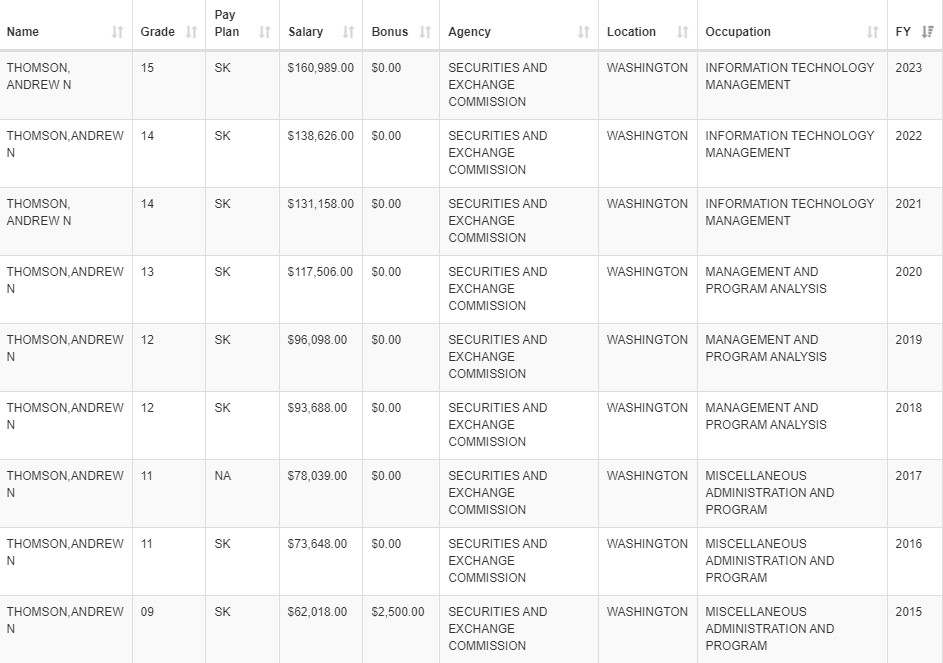

Andrew Thomson’s promotions came one after the other and his pay nearly tripled:

Here’s a fun photo; a short trip out the SEC Revolving Door, and the ETHgate connection to the SEC Division of Economic and Risk Analysis:

Four years after leaving the SEC (under investigation*) as Chief Economist and Director of the Division of Economic and Risk Analysis, Craig M. Lewis (left) invited the so-called architects of ETHGate to speak: Director of the Securities and Exchange Commission’s Division of Corporation Finance, William H. Hinman (second from left, next to Lewis) and SEC Chair Walter “Jay” Clayton (second from right), Vanderbilt Owen Dean M. Eric Johnson (far right).

*

In 2011, Craig Lewis promoted Scott Bauguess to Assistant Director of DERA’s Office of Corporate Finance. In 2013, less than a year before his abrupt departure, Mr. Lewis promoted Scott Bauguess to co-Deputy Director and co-Deputy Chief Economist of the Division of Economic and Risk Analysis. In 2016, Mr. Bauguess advanced again, into Mr. Lewis’ former position: Acting Director of the Division of Economic and Risk Analysis and Acting Chief Economist.

For context, this summarizes Scott Bauguess’ early career in DERA (footnote from my Whistleblower statement):