Reports by (mostly about) the SEC and its Office of Inspector General

Undersecretary of the Treasury for Domestic Finance Gary Gensler, Remarks to the Bond Market Association 1999 Annual Legal and Compliance Conference (October 28, 1999). Perhaps this is a fitting beginning to my library. Gensler is “very pleased” on the repeal of the Glass-Steagall Act that separated banking, securities, and insurance, gloating that “Finally, ‘we’ are the brink of success…”

I hope my Library (updated from my personal collection as time permits) aptly illustrates some of what came next for the SEC, and for the U.S. capital markets.

Shakeup at the SEC Corral, Who’s Keeping the Dogs In? CFO.com (May 1, 2002).

Letter to SEC Chairman Christopher Cox, Gary J. Aquirre (September 2, 2005).

Letter to Senate Committee on Banking, Housing and Urban Affairs, Gary J. Aquirre (May 30, 2006).

Testimony, Gary J. Aquirre, United States Senate Committee on the Judiciary (June 28, 2006).

Testimony part 1, Gary J. Aquirre, United States Senate Committee on the Judiciary (December 5, 2006).

Testimony part 2, Gary J. Aquirre, United States Senate Committee on the Judiciary (December 5, 2006).

Senate Committees on Finance and Judiciary, The Firing of an SEC Attorney and the Investigation of Pequot Capital Management (August 3, 2007).

Forbes, SEC Official Resigns As Report Blasts Performance (August 7, 2007).

SEC, Press Release, H. David Kotz Named New Inspector General at SEC (December 5, 2007).

SEC, Office of Inspector General, SEC’s Oversight of Bear Sterns and Related Entities: Consolidated Supervised Entity Program, Report No. OIG-446-A (September 25, 2008).

SEC, Office of Inspector General, SEC’s Oversight of Bear Stearns and Related Entities: Broker-Dealer Risk Assessment Program, Report No. OIG-446-B (September 25, 2008).

SEC, Press Release, Chairman Cox Announces End of Consolidated Supervised Entities Program (September 26, 2008).

SEC, Office of Inspector General, Report to SEC Chairman Cox, Re-Investigation of Claims by Gary Aguirre of Improper Preferential Treatment and Retaliatory Termination, Case No. OIG-431 (September 30, 2008).

SEC, Office of Inspector General, Investigation of Failure of the SEC to Uncover Bernard Madoff’s Ponzi’ Scheme, Report No. OIG-509 (August 31, 2009).

SEC, Office of Inspector General, Review and Analysis of the SEC OCIE Examinations of Bernard L. Madoff Investment Securities, LLC, Report No. OIG-468 (September 29, 2009).

SEC, Office of Inspector General, Program Improvements Needed Within the SEC’s Division of Enforcement, Report No. OIG-467 (September 29, 2009).

SEC, Office of Inspector General, Investigation of the SEC’s Response to Concerns Regarding Robert Allen Stanford’s Alleged Ponzi Scheme 1997-2009, Case No. OIG-526 (March 31, 2010).

Testimony, H. David Kotz, Inspector General of the SEC, Before the Financial Crisis Inquiry Commission (May 5, 2010).

U.S. House of Representatives, Committee on Oversight and Government Reform, Darrell Issa, Ranking Member, The SEC: Designed for Failure (May 18, 2010):

Complaint to the Council of the Inspectors General on Integrity and Efficiency Concerning the Securities and Exchange Commission’s Office of the Inspector General (April 5, 2011):

U. S. Senate Committee on Banking, Housing and Urban Affairs, Transcript, Oversight Hearing of the SEC’s Inspector General’s Report on the Investigation of the SEC’s Response to Concerns Regarding Robert Allen Stanford’s Alleged Ponzi Scheme and Improving SEC Performance (September 22, 2010).

SEC, Office of Inspector General, Excessive Payment of Living Expenses in Contravention of OPM Guidance for a Headquarters Senior Official, Case No. OIG-561 re: Henry T. C. Hu, Director of SEC Division of Economic and Risk Analysis (September 7, 2011).

SEC, Office of Inspector General, Destruction of Records Related to Matters Under Inquiry and Incomplete Statements to the National Archives and Records Administration Regarding that Destruction by the Division of Enforcement Case No. OIG-567 (October 5, 2011).

SEC, Press Release, SEC Inspector General H. David Kotz to Leave Commission (January 17, 2012).

United States Postal Service, Office of Inspector General, Report of Investigation: SEC Office of Inspector General: H. David Kotz – Executive Misconduct (September 17, 2012).

SEC, Office of Inspector General, SEC Records Management Practices , Report No. OIG-505; (September 30, 2012).

Complaint, David P. Weber v. U.S. Securities and Exchange Commission (November 12, 2012).

The Money Cop, Time, Rana Foroohar (December 24, 2012).

Project on Government Oversight (POGO) Dangerous Liaisons: Revolving Door at SEC Creates Risk of Regulatory Capture (February 11, 2013).

Review of the Commodity Future Trading Commission’s Oversight and Regulation of MF Global, Inc. (May 13, 2013)

E Pluribus Unum, RankAndFiled.com is like the SEC’s EDGAR Database, but for Humans (February 19, 2014).

SEC, Office of Inspector General, Semiannual Reports to Congress, 1994-2024.

Letter from Robert J. Jackson, Jr., Columbia University Law School, to the SEC Inspector General describing “how the Commission’s FOIA staff continues to flout federal law and the directives of the President by denying the public access to the Commission’s records.”; (October 23, 2014). Mr. Jackson later served as SEC Commissioner from January 11, 2018 to February 14, 2020.

SEC, Office of Inspector General, The SEC Made Progress But Work Remains To Address Human Capital Management Challenges and Align With the Human Capital Framework (Report No. 549; September 11, 2018).

Integrity Committee, Council of the Inspectors General on Integrity and Efficiency (CIGIE): Report of Investigation: Requests IC890 and IC909, SEC Office of Inspector General Carl W. Hoecker, Allegations of Misconduct (April 5, 2019).

Integrity Committee, CIGIE: Report to Congressional Committees and SEC Chairman Jay Clayton, Report and Recommendation on Serious Misconduct by SEC Inspector General Carl W. Hoecker (October 18, 2019).

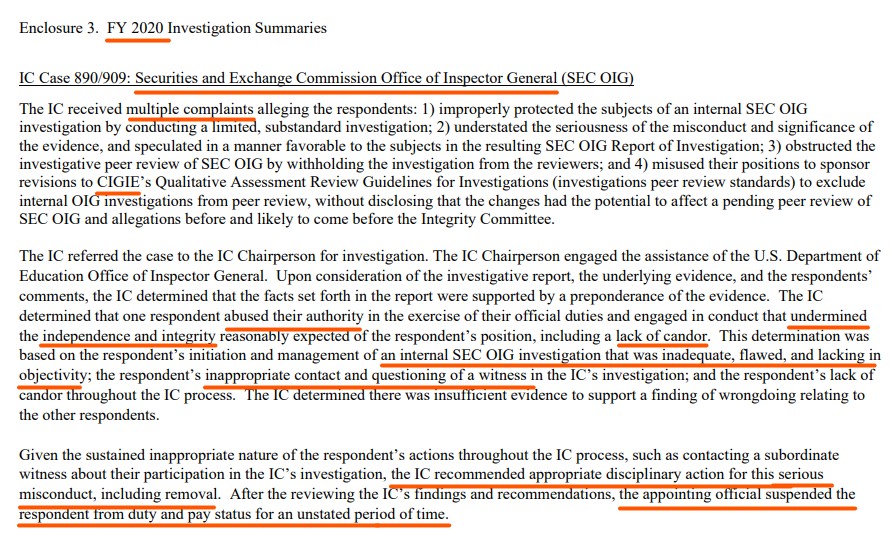

CIGIE Annual Report to President and Congress, FY 2020 Investigation Summary and Recommended Disciplinary Action, page 9, concerning SEC Inspector General Carl W. Hoecker (December 8, 2020):

SEC, Office of Inspector General, The Inspector General’s Statement on the SEC’s Management and Performance Challenges, October 2020 (October 8, 2020). See 2021 SEC IG Statement. See 2022 SEC IG statement.

SEC, Office of Inspector General, Review for Racial and Ethnic Disparities in the SEC’s Issuance of Corrective and Disciplinary Actions from January 1, 2017 – August 31, 2020 (August 26, 2021).

Reuters, Exclusive: SEC’s internal watchdog kept job despite ‘serious misconduct’ finding (December 7, 2021).

POGO, Sex, Lies, and Impunity: SEC Watchdog Mishandled Probe (December 7, 2021). Includes previously non-public 48-page Report of Investigation on the SEC Inspector General.

POGO calls for the Immediate Removal of SEC Inspector General Carl Hoecker (January 23, 2022).

SEC, Press Release 2022-71, Inspector General Carl W. Hoecker to Retire from SEC (April 27, 2022).

Empower Oversight Whistleblowers and Research (EMPOWR), RE: Referral of Evidence of Violations of Ethics Directives by the former SEC Director of the Division of Corporation Finance, (May 9, 2022).

EMPOWR, Amended Complaint to compel compliance by the SEC with the Freedom of Information Act, including the records concern potential conflicts of interest by former high-level officials at the SEC relating to cryptocurrencies (August 2, 2022).

FTX Capital Markets LLC BrokerCheck report, no longer available online (November 17, 2022). The existence of an SEC and FINRA broker-dealer, registered since April 23, 2012, gave SEC regulatory authority over all FTX entities. The Broker-Dealer Risk Assessment Rule 17(h) was enacted in 1992, following the collapse of Drexel Burnham Lambert Group. It requires the SEC to monitor the financial and operational condition of a B-D’s affiliates to prevent contagion from the parent or other affiliates.

Majority Whip Tom Emmer: SEC Chair Gensler is an “Incompetent Cop on the Beat” (April 23, 2023).

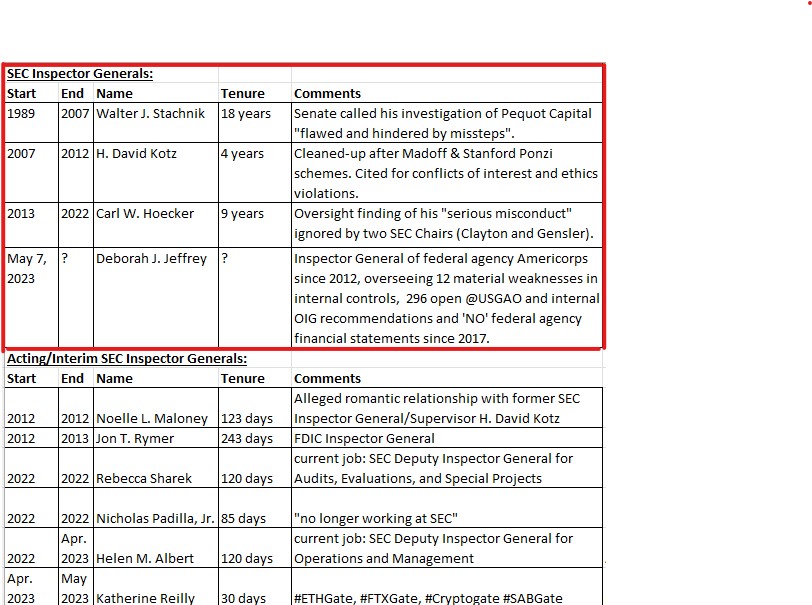

The history of the SEC Inspector General’s Office:

SEC Office of Equal Employment Opportunity

SEC, Fiscal Year 2017 Annual Equal Employment Opportunity Program Status Report, Management Directive 715. See involuntary separations of 6 SEC employees (1 Hispanic or Latino female, 2 White females, 1 Black or African-American male, and 1 Asian female) reported on page 132 in Workforce Data Table A-14.

SEC, Fiscal Year 2018 Annual Equal Employment Opportunity Program Status Report, Management Directive 715. See involuntary separations of 4 female SEC employees (2 White females, 1 Black or African-American female, and 1 Asian female) reported on page 156 in Workforce Data Table A-14.

SEC, Fiscal Year 2019 Annual Equal Employment Opportunity Program Status Report, Management Directive 715. SEC omits required disclosures of involuntary separations of SEC employees. See pages 195-197 in Workforce Data Table A-1.

SEC, Fiscal Year 2020 Annual Equal Employment Opportunity Program Status Report, Management Directive 715. See involuntary separations of 2 Black or African-American male SEC employees reported on page 167 in Workforce Data Table A-1.

SEC, Fiscal Year 2021 Annual Equal Employment Opportunity Program Status Report, Management Directive 715: SEC redacts disclosures of involuntary separations of SEC employees. See pages 191-195 in Workforce Data Table A-1.

SEC, Fiscal Year 2022 Annual Equal Employment Opportunity Program Status Report, Management Directive 715. See involuntary separations of 3 female SEC employees (2 White females, 1 Black or African-American female) reported on page 408 in Workforce Data Table A-1. This report is not yet public on the SEC website as of June 2023; here’s the copy I obtained via FOIA from the U.S. Equal Employment Opportunity Commission:

U.S. Government Accountability Office (GAO)

GAO, SEC Human Capital Challenges Require Management Attention, GAO-01-947 (September 17, 2001).

GAO, SEC Some Progress Made on Strategic Human Capital Management, GAO-06-86 (January 10, 2006).

GAO, Improving Personnel Management Is Critical for Agency’s Effectiveness, GAO-13-621 (July 18, 2013).

GAO, Securities and Exchange Commission: Actions Needed to Address Limited Progress in Resolving Long-Standing Personnel Management Challenges, GAO-17-65 (December 29, 2016).

GAO, Securities and Exchange Commission: Personnel Management Shows Improvement, but Action Needed on Performance Management System, GAO-20-208 (December 19, 2019).

GAO, Securities and Exchange Commission: Systematically Assessing Staff Procedures and Enhancing Control Design Would Strengthen Internal Oversight, GAO 20-115 (December 19, 2019).

GAO, Securities and Exchange Commission: Employee Views of Personnel Management Improved, but Action Needed on Measuring Diversity and Inclusion Goals, GAO 23-105459 (December 22, 2022).

GAO, Securities and Exchange Commission—Applicability of the Congressional Review Act to Staff Accounting Bulletin No. 121, GAO B-334540 (October 31, 2023).

SEC Press Releases, Speeches, etc.

SEC, Oversight of Public Company Financial Reporting Process (April 19, 2018).

SEC, Press Release 2020-280, Mike Willis Named Associate Director in Division of Economic and Risk Analysis (November 12, 2020).

SEC, Press Release 2020-284, SEC Chairman Jay Clayton Confirms Plans to Conclude Tenure at Year End (November 16, 2020).

SEC, Press Release 2023-146, SEC Obtains Emergency Relief to Halt Utah-Based Company’s Crypto Asset Fraud Scheme Involving 18 Defendants (August 3, 2023). This Press Release was removed from the SEC’s website on March 20, 2024 – two days after Judge Shelby’s rebuke of the SEC (below). Does the SEC seek to erase history?

SEC, Complaint, DEBT Box, et al. (August 3, 2023).

DEBT Box Order, by Utah District Court Chief Judge Robert J. Shelby concerning the SEC’s ‘myriad and repeated instances of misconduct’ and ‘abuses of the judicial process’ (March 18, 2024).

Etcetera

SEC, Pamela Gibbs, Director, SEC Office of Minority and Women Inclusion, “Now She’s Cooking”, HGTV Magazine (October 2022). Under Ms. Gibbs executive leadership, 125+ SEC employees (that we know of) had their federal careers terminated or damaged, without due process or controls.

Cheers, Pamela!