A little bit of this and that

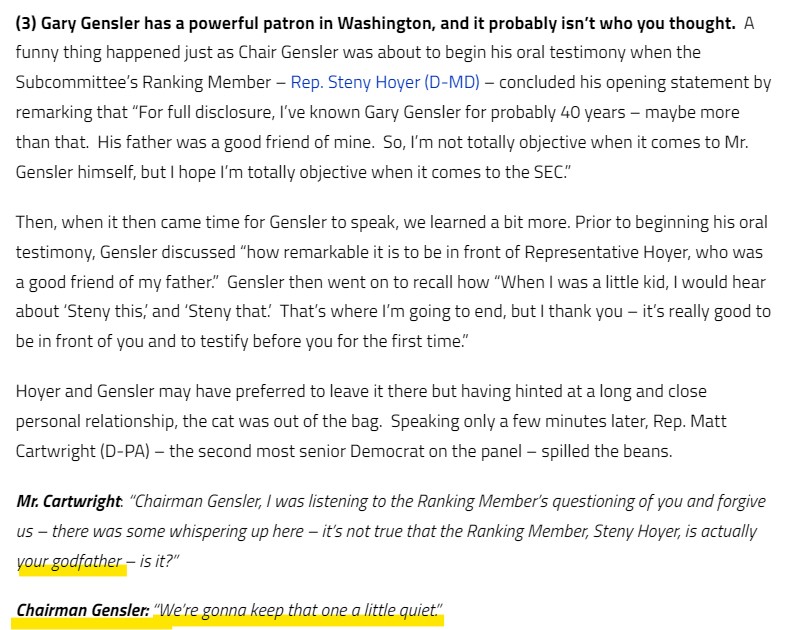

Who says Gary Gensler is a gangster?

The Democrats Stealth Fighter, Baltimore Sun, Julie Hirschfeld Davis (November 3, 2002).

Analysis: Nine Takeaways from SEC Chair Gary Gensler’s March 29th Appearance before the House Appropriations FSGG Subcommittee, LXR Group (March 30, 2023).

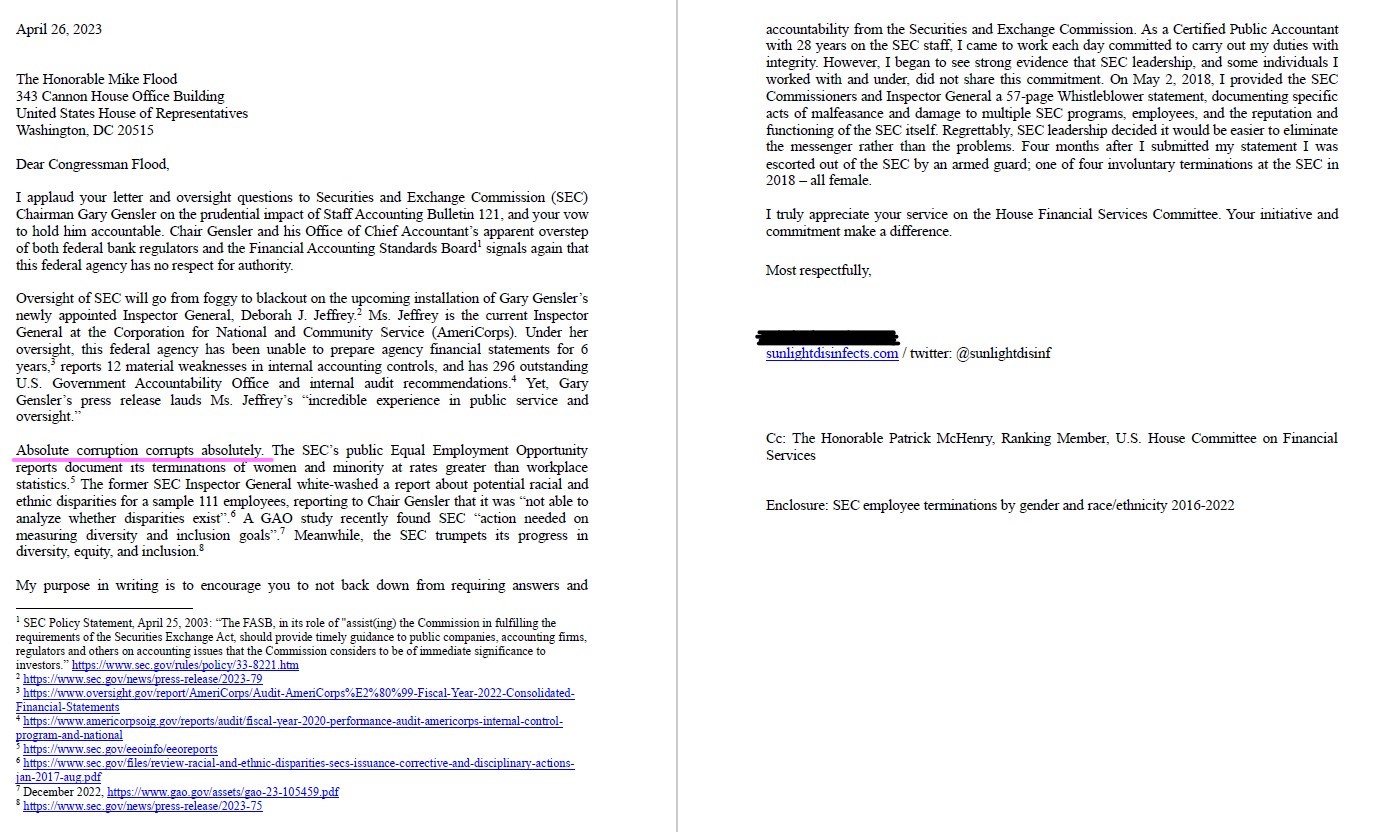

SEC Corruption: Who Has the Power and Duty to Disclose?

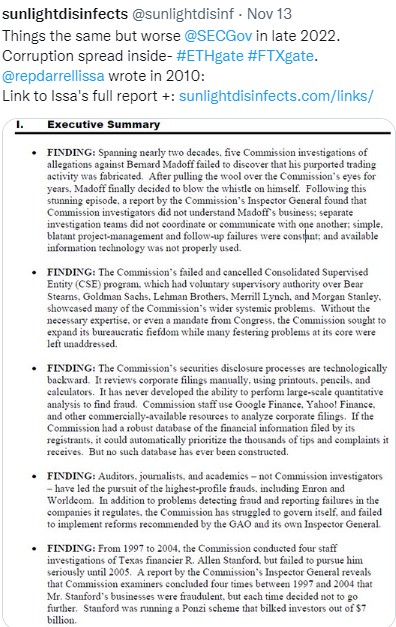

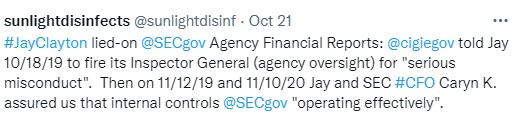

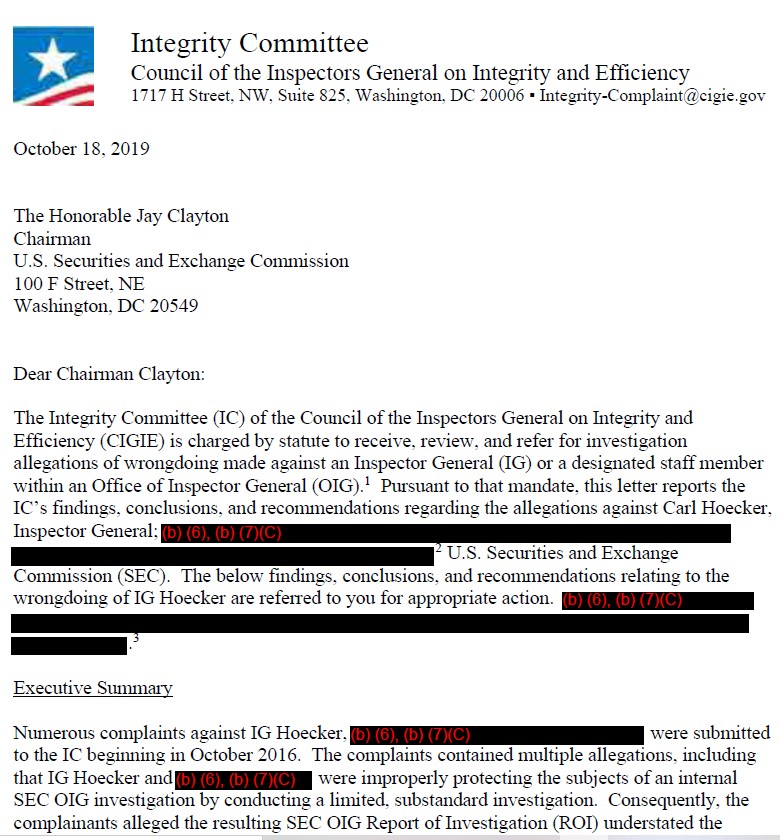

Incompetence, greed, and corruption are nothing new at the SEC. Its alleged leaders and oversight have a long history of ignoring professional and ethical responsibilities. The SEC Chief Accountant, Chair, and Inspector General are powerful government positions requiring awesome responsibility to duty. Instead, the SEC has operated under cloak, hired cowardly leaders, created crises, and tragically turned against the American people who have no choice but to fund this agency’s dysfunction.

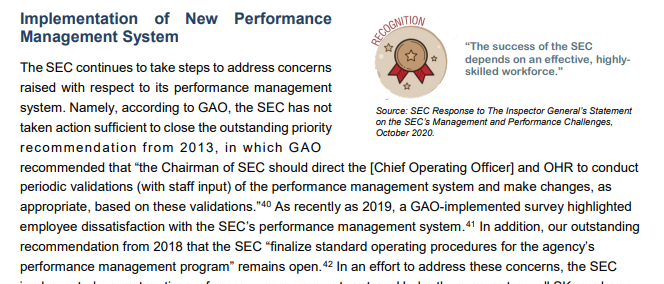

SEC Human Capital Has Been Poorly Managed for the last 25 years

Poor leadership in key SEC roles, coupled with its long history of dysfunction in managing its human capital (staff), explain the agency’s inability to manage itself, much less protect the public. Some of the plethora of documents evidencing an agency without credible policies, procedures, or protections for its workforce:

2001: SEC Human Capital Challenges Require Management Attention (GAO 01-947).

2003: Updated Personnel Guidance (SEC OIG Audit Memorandum 28).

2003: SEC redesigns Performance Management System and adds pay-for-performance without consulting its Union. The agency scrapped these systems after several independent studies and a federal arbitrator found them to be discriminatory and ineffective.

2006: Some Progress Made on Strategic Human Capital Management (GAO 06-86).

2006: Federal Service Impasse Panel decision breaks compensation and benefits agreement impasse with SEC Union: defines 2007 changes to performance management systems; adds new “pay for performance”.

2007: SEC Union Wins Major Arbitration Decision Declaring SEC Merit Pay System Discriminatory; later update here

2007: Enforcement Performance Management (SEC OIG Audit 423).

2007: Agencies Have Implemented Key Performance Practices, but Opportunities Exist for Improvement (GAO 07-678) reports “The SEC Appears to Rate Its Employees’ Performance at a Much Lower Level than Other Financial Regulatory Agencies Rate Theirs”.

2007: SEC Union wins victory over SEC Merit Pay (pay for performance) System; NTEU Press Release on SEC Merit Pay Arbitration Victory; transparency concerns

2008: SEC Executive Director Ruiz testifies before House subcommittee on SEC Merit Pay

2008: SEC suspends Pay for Performance program

2008: SEC separates performance management from merit pay

2008: SEC eliminates ‘steps’ adopts pay ‘ranges’

2008: SEC and Union reach agreement on Merit Pay for 2008

2008: NTEU reaches a favorable settlement — including $2.7 million in back pay, as well as salary adjustments — in resolution of its grievances challenging the lawfulness of the SEC’s arbitrary and subjective merit pay program.

2008-2011: SEC redesigns Performance Management System again; transitions to five-level employee performance rating system. (SEC OIG Semi-annual Report to Congress, September 2010).

2010: SEC “undergoing a rigorous process and phased-in implementation of a new performance management system…called Evidence-Based Performance Management”.

2011-13: SEC adopts pass/fail (acceptable/unacceptable) Performance Management System.

2013: Improving Personnel Management is Critical for Agency’s Effectiveness (GAO 13-621).

2015: SEC Promotions Barrier Analysis reports “Lack of full adherence to uniform personnel practices and guidelines” (email from SEC Chair White, November 24, 2015). See also: SEC FAQ on Promotions Barrier Analysis.

2015-17: SEC redesigns Performance Management System.

2016: Actions Needed to Address Limited Progress in Resolving Long-Standing Personnel Management Challenges (GAO 17-65).

2016: Final Closeout Memorandum: Audit of the SEC’s Hiring Practices (SEC OIG Memorandum, August 19, 2016).

2018: The SEC Made Progress but Work Remains To Address Human Capital Management Challenges and Align With the Human Capital Framework: finding lack of validations and standard personnel operating procedures (SEC OIG Report 549).

2018: SEC engages OPM to assist with assessing and implementing a performance management program (as a result of deficiencies and recommendations from the SEC OIG’s 2018 report).

2019: Personnel Management Shows Improvement, but Action Needed on Performance Management System (GAO 20-208).

2021: SEC Performance Incentive Bonus program operated by its Union, discontinued after one year after criticism and questions in 2022 GAO report 23-105459 (following).

2022: Employee Views of Personnel Management Improved, but Action Needed on Measuring Diversity and Inclusion Goals (GAO 23-105459).

2022: The SEC Can Improve in Several Areas Related to Hiring (SEC OIG Report 572).

2024: Opportunities Exist to Strengthen the SEC’s Office of Equal Employment Opportunity Programs and Opportunities (SEC OIG Report 581).

The short attention span of the SEC Inspector General for my whistleblower report :

I requested by FOIA the SEC Inspector General’s records after receiving my Whistleblower Report. What I learned: The SEC Inspector General opened an [non-]investigation on July 10, 2018, categorized it as “Employee Integrity”, and closed it the same day:

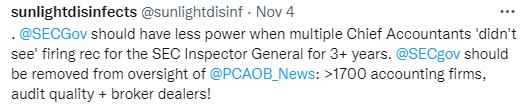

A slideshow of misc. posts on X :

Just for fun, an SEC – ETHgate moment:

July 13, 2023: Ripple lawsuit summary judgement:

Link to this video on X by @NFAdotcrypto:

What Was and What I’m Asking For Again

My lawsuit seeks my re-employment at SEC. On the 6th anniversary of my termination, I found this in the desk drawer: my final SEC business card. Or perhaps not…